Are you in debt? If so, you’re not alone. Consumer debt has increased steadily over the last ten years, and the majority of us are working to figure out how to handle repayment.

We all know that when you have debt, there’s usually a debt collector. But what exactly is debt collection and how does it work? In this article, we’ll demystify debt collection and share sound advice on what to do if a collector is banging down your door or blowing up your phone.

What is Debt Collection?

Debt collection is the process of pursuing repayment for an overdue loan that is owed to a creditor. This process is usually carried out by debt collectors, who may or may not work for a debt collection agency.

Ideally, you would be able to pay back your debts per an agreed-upon schedule. But in cases where the money hasn’t been repaid as planned, a debt collector may come to work out a repayment plan. These overdue debts can be of any type, including:

- Credit card debt

- Personal loan debt

- Student loan debt

- Medical debt

- Car/auto loan debt or title loan debt

- Unpaid utility bills

When a lender or creditor hires a debt collector, they typically pay the debt collector a percentage of the debt collected. Debt collectors usually only get paid if they secure the errant debt payment — which explains their reputation of being persistent.

Debt Collection Agencies

A debt collection agency is a financial establishment that assists lenders and creditors in recovering their money after a loan has defaulted or become overdue. These are third-party institutions hired specifically to collect money owed.

Debt collection agencies sometimes purchase debt from lenders. When a lender determines that repayment of a loan from a borrower is unlikely, they may “sell” the debt to a collection agency. The collection agency then attempts.

How Does Debt Collection Work?

When your debt payment is past due, your lender or creditor will contact you. If you don’t respond, they’ll make continued attempts. Eventually, the lender will likely suspend your account and transfer it to a debt collector or debt collection agency.

Once you’ve spoken with the debt collector, they’ll work to create a repayment plan for you. It’s in their interest to find a plan that works for you so that they can recoup their money, so don’t feel that you have to agree to something beyond what is financially possible for you.

If you continue to be unreachable, a debt collector may take legal action. It’s possible for collectors to find out your bank information and ability to repay. Those able to repay may receive a court order garnishing their wages to force repayment.

Why is a Debt Collector Contacting You?

A debt collector contacts you when you have overdue bills. If your lender or creditor has had a hard time reaching you, they may have turned your account over to a debt collector. Collectors are highly motivated to convince you to repay your debts.

Don’t panic when you receive these calls. If you impulsively agree to a repayment plan you can’t afford, you might be stuck with it. Keep your head in the conversation and work to create a plan that works for you. If you feel you can’t make a sound decision at the moment, give them another time to contact you so you can take a calmer look at your current financial picture.

What to do if you have Debt in Collection

Ideally, you’ll want to find a way to repay your debt as quickly as possible. When working out at repayment plan, it’s smart to:

- Take your time and take notes during discussions with your collector. Ask the questions you need to ask. Take notes on who you are speaking to and what they claim you owe.

- Request relevant documents. This can help with verification of existing debts and record-keeping.

- Be honest about repayment. It will serve both parties to come to a plan that realistically gets the debt repaid. Don’t agree to something that is financially infeasible at the moment. Make a budget for yourself that includes repayment.

- Investigate possible scams. If you have any concerns about the legitimacy of a call from a collector, investigate it before you take any action to repay. Request a debt validation letter or go through a credit bureau to confirm that the collector is legitimate.

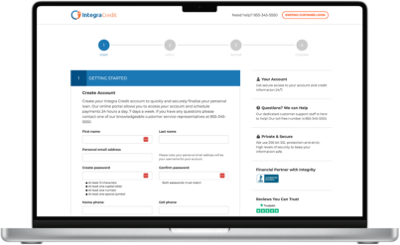

Apply in minutes, quickly & securely

- Complete an online application

- Receive a decision quickly

- Review and sign the agreement

- Get cash directly into your bank account